A physician who maintains a professional medical practice in New Jersey and has a responsibility for patient care is required to be covered by medcal malpractice liability insurance issued by a carrier authorized to write medical malpractice liability insurance policies in the Statem in the sum of $1 per occurance and $3 million per policy year unless renewal coverage includes the premium retroactivr date, the polich shall proive for extended reporting endorsement coverage for claim mades policies, also known as “tail coverage,” or, if such liability coverage is nott avaliable, a letter of credit for at least $500.000.

State Statutes

Physicians

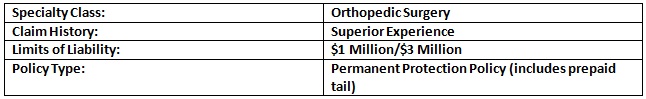

N.J.STAT.ANN. § 45:9-19.17 – Physicians, mandatory medical malpractice liability insurance coverage– a. A physician who maintains a professional medical practice in this State and has responsibility for patient care is required to be covered by medical malpractice liability insurance issued by a carrier authorized to write medical malpractice liability insurance policies in this State, in the sum of $1,000,000 per occurrence and $3,000,000 per policy year and unless renewal coverage includes the premium retroactive date, the policy shall provide for extended reporting endorsement coverage for claims made policies, also known as “tail coverage,” or, if such liability coverage is not available, by a letter of credit for at least $500,000.

The physician shall notify the State Board of Medical Examiners of the name and address of the insurance carrier or the institution issuing the letter of credit, pursuant to section 7 of P.L.1989, c. 300 (C.45:9-19.7).

b. A physician who is in violation of this section is subject to disciplinary action and civil penalties pursuant to sections 8, 9 and 12 of P.L.1978, c. 73 (C.45:1-21 to 22 and 45:1-25).

c. The State Board of Medical Examiners may, pursuant to the “Administrative Procedure Act,” P.L.1968,c. 410 (C.52:14B-1 et seq.), establish by regulation, minimum amounts for medical malpractice liability insurance coverage and lines of credit in excess of those amounts required pursuant to subsection a. of this section.

d. The State Board of Medical Examiners shall notify all physicians licensed by the board of the requirements of this section within 30 days of the date of enactment of P.L.2004, c. 17.

N.J.STAT.ANN. § 45:9-22.4 – Definitions – For the purposes of this act:

“Practitioner” means a physician, chiropractor or podiatrist licensed pursuant to Title 45 of the Revised Statutes.

New Jersey Medical Malpractice Liability Insurance Act

N.J.STAT.ANN. § 17:30D-2 – Purpose; application to medical malpractice liability insurance – a. The purpose of this act is to assure that medical malpractice liability insurance is readily available to licensed medical practitioners and health care facilities by establishing a reinsurance association, requiring the association to reinsure medical malpractice liability insurance policies issued by certain providers and permitting the association to write such policies on a direct basis, to determine when the association has Advocacy Resource Center © 2012 American Medical Association. All rights reserved.23 sustained a deficit, and to provide for recoupment of losses resulting from the operation of the association through surcharges on insureds and to grant the Commissioner of Insurance temporary emergency powers to set up and operate the reinsurance association if such insurance is unavailable for any class of licensed medical practitioners or health care facilities.

b. This act shall apply to medical malpractice liability insurance as defined herein.

N.J.STAT.ANN. § 17:30D-3 – Definitions – As used in this act:

c. “Licensed medical practitioner” means and includes all persons licensed in this State to practice medicine and surgery, chiropractic, podiatric medicine, dentistry, optometry, psychology, pharmacy, nursing, physical therapy and as a bioanalytical laboratory director.

N.J.STAT.ANN. § 17:30D-10 – Additional premium charges on policies of medical malpractice liability insurance – For the purpose of providing moneys necessary to establish the recovery fund in an amount sufficient to meet the requirements of this act, the commissioner shall establish reasonable provisions through additional premium charges for policies of the various categories and subcategories of medical malpractice relationship to the loss experience both past and prospective of the association and its members attributable to such category or subcategory.